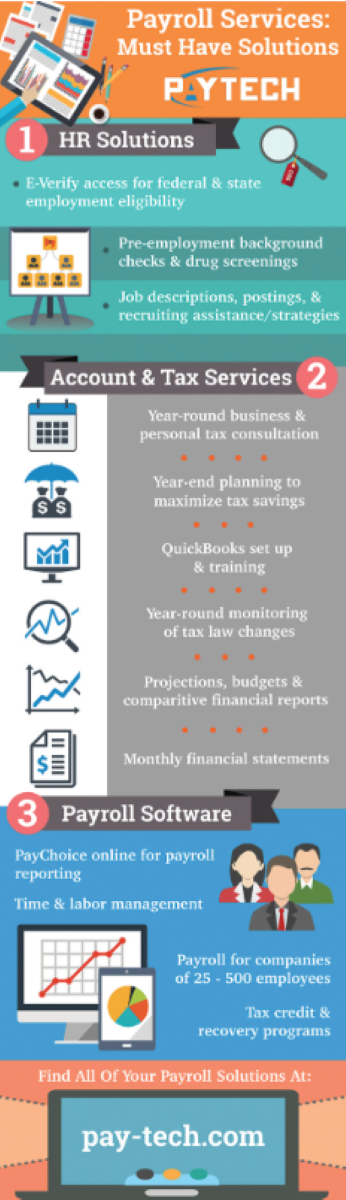

If you are the owner of a business, you know just how vital payroll services are to keeping your company running smoothly. Some must-have solutions more than often reach beyond the services of payroll and include HR solutions, as well as accounting and tax services. To ensure that your company is in capable hands, make sure they include these essential business services:

Big or small, online HR solutions are critical to helping your company grow and succeed. This could involve pre-employment background and drug tests, E-Verifying access, new hire onboarding, or job recruiting strategies. Your payroll services company should always focus on keeping communication with your current employees as well as filtering through potential ones that fit your criteria and will help your business expand.

These type of payroll services should be monitored year-round to prepare for business tax savings, tax law changes, and monthly financial statements. You may use helpful software like QuickBooks, which assist you in managing payroll, inventory, and sales. Utilizing payroll services benefit your company by making it simpler organize projections, budgets, and comparing financial reports online. However, staying on top of business tax law updates can be incredibly time-consuming. That is why utilizing a tax services company like PayTech can be an incredible asset for your business.

Ultimately, reliable business solution companies like PayTech recommend using payroll software like PayChoice Online that are key maintaining accurate records of employee hours and labor. It’s important to find a payroll solution company that can support small and large companies alike. Your payroll software should provide precise results no matter what size your business is, and should also assist you in tax credit and recovery programs. Companies like PayTech take great pride helping you manage the details of your business so that you can focus on making your company thrive. If you’re interested in developing your business, contact a PayTech representative today at 602.900.8807.