There are many reasons why payroll fraud cases exist. Sometimes, it’s just a matter of pure greed – the wrong people are given too much trust and abuse it as much as possible. In other cases, fraud and employee theft occur because of a lack of oversight and accountability. Fraud even occurs because businesses are too free with their information and make it too easy for the wrong types of people to obtain that which should be hidden. No matter what the case, this type of fraud happens because there is an opportunity for people to take advantage of what might be a particularly lucrative security opening.

Fraudulent activity happens differently in depending on the types of businesses. As a rule, though, about one in four companies are going to deal with some kind of fraud when it comes to payroll. This fraud does, however, tend to vary greatly depending on the size of the business. Between differences in the way that payroll is done and the general relationships between employers and workers, only certain types of fraud work at different levels. Once a business is aware of what types of payroll fraud are most likely to occur, though, that business can better prepare its own fraud defenses.

On average, direct fraud is more common in small businesses than in their larger counterparts. While this type of fraud happens in about twenty-seven percent of all businesses, it’s an issue for closer to fifty-percent of all smaller businesses. As such, it’s always important for a smaller business to keep track of who is looking at their payroll, how it is processed, and ultimately what procedures are used to ensure that the money being paid out is equal to the labor that’s actually being done for the business. Failure to do so can lead to the kind of catastrophic losses for which a small business is simply not prepared.

It should also be noted that smaller businesses are more often victims of internal fraud than external fraud. While it’s become more common for thieves to target small organizations, it’s technically easier for those in charge of payroll to defraud a business when they are the only ones actually looking at the books. In many cases, small businesses get to experience all the same types of fraud that their larger counterparts experience with an added helping of fraud that requires too much trust to work in a larger company.

Once a business becomes bigger, certain types of fraud become less likely. Any type of fraud that requires having unfettered, individual access to payroll is just less likely to occur, if only because more eyes will be on the books than in a smaller company. Mid-sized companies do, unfortunately, often get hit with many other types of fraud. In fact, mid-sized companies are perfectly positioned to not only deal with many of the same types of fraud as small businesses but to deal with the similar issues as larger businesses.

Larger corporations are fantastic targets for fraud. Fortunately, most realize this and they put systems in place to deal with that fraud. That’s why large, spectacular fraud cases are so commonly portrayed on the news – they’re shocking, because most companies can catch them before they reach the point of no return. Instead, larger companies tend to deal with many minor instances of fraud that end up costing the company more money over a greater period of time. It’s not necessarily better than what smaller companies have to deal with, especially when the problems become systemic.

Timesheet fraud is incredibly common in larger corporations, especially when employees self-report their hours. Ghost employees are likewise quite common, especially when it’s possible for an employee to get lost in the shuffle between multiple branches and remote commuting. It’s very easy for hours to get lost here or there, especially if the business is in a growth cycle. Large businesses also tend to have some real problems with employee classification, especially when it comes to management positions. When these issues become a problem, the company might be expected to weather major labor-related fines.

Certain types of fraud are more common than others. While there are certainly dozens of different ways for individuals to defraud a company, a few types of fraud tend to crop up at businesses of all sizes. These types of fraud are generally fairly low-tech, but they are also often quite successful. The best way to defend against them is to know what they are and the signs for which you should be looking out. Four types of fraud tend to stand out in the business of all sizes and thus should be your primary security concerns.

Ghost employees are a fairly common issue when it comes to the world of payroll fraud. They’re often a result of putting too much trust into a particular time-keeping system, allowing employees to make it onto the payroll with little oversight over those who have added them to the list. Indeed, the ghost employee may not be an employee at all – but he or she is definitely drawing a paycheck.

These employees come in a few different forms. One type is the true ghost, an employee who doesn’t actually exist. Another is a real person, but one who doesn’t actually show up to work at the business. In either case, an excess individual is put on the payroll and checks are cut for him or her. The money may go back into the pocket of the person in charge of payroll or it might end up being split between several co-conspirators. No matter the specifics, though, it can be a major drain on the finances of the company.

Not all forms of fraudulent payroll activity are done on the part of the employees or even an outside agent. Some forms of payroll fraud happen at the management level. One of the most common types of fraud is employee misclassification, which usually occurs as an attempt to avoid paying taxes and/or benefits to an employee who might otherwise be eligible for the same type of compensation as others in the company.

The most common way this happens is through the misclassification of a standard employee as an independent contractor. 1099 contractors can be incredibly attractive to some businesses because there’s not the same tax burden involved as found with typical employees; but a business can’t just declare employees to be contractors at a whim. Contractors are not the same as employees, and any attempt to treat them as such might be seen as fraudulent by the IRS.

It is also common to deal with misclassification when it comes to management. Classifying an employee as management might allow the business to make certain requirements (frequently a lack of overtime pay), but if the employee doesn’t actually make management decisions, this can be seen as a misclassification. Running afoul of a labor board or the IRS is common for businesses that fail to classify their employees correctly.

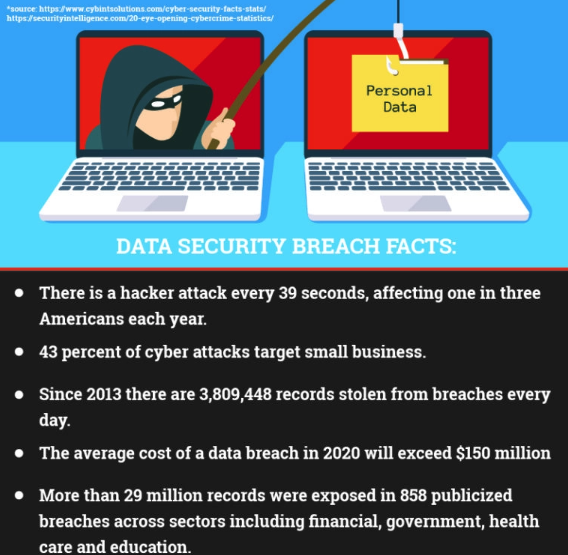

Payroll security breaches can come in many shapes and forms. In some cases, these breaches are as simple as someone having access to payroll information that shouldn’t have access. In others, though, it can constitute a full breach of the company’s data storage systems, giving the infiltrator access to a wealth of information as well as several different methods of taking money from the company. Payroll security breaches are serious issues that require serious steps to fix.

Payroll security breaches are most easily handled by keeping better track of who has access to your payroll information.Limiting points of contact make it not only easier to keep the information safe, but also easier to track down the source of any breaches. Taking basic safety steps to ensure that no more information than necessary leaves your business is often a good way to shut down these leaks before they occur.

Payroll security breaches may, however, be indicative of a systemic information security problem. If such a breach does occur, it’s important for a business owner to take a look at the security measures in place and find out how effectively they are being used. Once you are aware of your security shortcomings, you can put plans in motion to ensure that these breaches occur less often.

If you’re looking for a particularly common type of fraud, the first place you should look is always at timesheets. It’s very easy for numbers to get mixed up and fudged, especially by individuals looking to make – or save – money. The time worked by an employee is what is legally owed to be paid, so it’s important that the time on the sheet actually matches the time worked. Even adding a few minutes to a time sheet is technically fraud, so be on the lookout.

The easy way to deal with this type of fraud is to add systems to guard against it. Electronic systems tend to be less prone to abuse by employees, but that doesn’t mean that abuse cannot occur. Timesheet fraud can still be perpetrated by managers and by supervisors, especially when they are under orders to keep hours down. If an individual chooses to alter the time forms, he or she is committing fraud.

It is important to guard against this type of fraud from both employees and managers. Always make sure there is a third party available to make sure that timesheets are reconciled correctly. While this might be extra work, it’s also the easiest way to make sure that this type of fraud doesn’t fall through the cracks. When you can eliminate timesheet fraud, you can help to ensure that your payroll accurately reflects the hours worked by your employees.

Detecting payroll fraud isn’t necessarily easy, but it’s often less complex than you might think. The best way to start is with a clear understanding of what your payroll should be every month. If you can check your real numbers against your assumed numbers, it will be easy to see if there are any wild discrepancies. This type of basic oversight can go a long way towards ensuring that you aren’t missing anything that should be easily spotted.

Basic oversight is, in and of itself, often one of the most important parts of detecting fraud. There should never be a situation in which only one person oversees the payroll operations. Even if this means that another person simply has to sign off on the payroll it is processed, this helps to ensure that errors and omissions are quickly caught. In most cases, it won’t take a massive amount of technical ability or many high-end tools to do the work of the second pair of eyes.

In fact, it’s important that you audit your payroll security system on a regular basis. Figure out what’s working, what’s not, and what you can realistically change. The more work you put into detecting payroll fraud, the less work you’ll have to do to prevent it from occurring.

Preventing fraud takes several steps. The first, generally speaking, is vigilance. It’s important that you know who works for you, who is in charge of your payroll, and what type of numbers you should see on a daily basis. If you aren’t in a position to monitor your payroll yourself, you should have someone you trust monitoring the numbers – and someone else you trust ensuring that the other person isn’t left in a position where temptation becomes too strong.

Common sense is also invaluable when it comes to preventing payroll fraud. Don’t print excess information on your checks, keep all of the paperwork locked up when it’s in use, and make sure that someone in management meets every new employee added to the payroll. These are little steps that don’t really take any extra time, but they can help you to prevent some of the most common types of fraud. Exercising just a modicum of caution in the way you handle your payroll process will allow you to make sure that your business isn’t an easy target.

As you can see, payroll fraud can occur no matter what the size of your business. It takes quite a bit of work to prevent it from occurring, but even then you can be sure that certain people will continue to look for ways to defraud your company. The best way to prevent this from occurring is to know whether or not the measures you have in place today can realistically defend against a fraud attempt tomorrow.