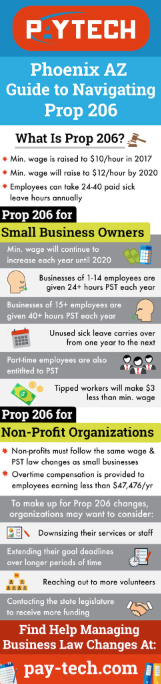

There’s no doubt that the Prop 206 is on every business owner’s mind when planning out their new business year and financial goals. This is because Arizona Proposition 206 has raised the minimum wage to $10 per hour, and gives employees between 24 to 40 hours of paid sick leave each year, depending on the size of their business. Larger companies are not as affected by this proposition being passed, because they already offered these features beforehand. However, this does significantly change things for small business and non-profit owners alike. Here is how Arizona minimum wage 2017 will change the way you run your business.

Many small business owners have mixed feelings about Prop 206, and for good reason. An increase in minimum wage is estimated to drive up sales for local companies which can be reinvested into payroll and growing their company. Not to mention that employees will have more incentive to keep their current jobs. Despite that, the effects of minimum wage will also make it difficult for employers to keep as many employees on staff if they can’t make enough profit each month. Because payroll is generally the largest expense to small businesses, employers will be forced to downsize their company or hire less staff to make up for it. This may narrow a company’s staff down to more educated or skilled professionals, but it will still put many qualified people out of their jobs.

Further detail on what is required of employers by Prop 206 is that businesses comprised of 15 or more employees collect an hour sick leave for every 30 hours worked. This will max out at 40 hours annually. Workers employed at smaller companies with less than 15 workers can accrue 24 hours a year. This will require business owners to install a system to track paid sick leave to ensure accurate data is recorded for both the employee’s and company’s sake. Aside from sick leave, minimum wage will continue to increase to $12 per hour in the Phoenix AZ area by 2020, whereas areas like Flagstaff AZ will raise their minimum wage to $15 per hour by the same year. Implementing and keeping up with these changes may involve help from an AZ payroll assistance company.

When it comes to the Arizona Proposition 206, non-profit organizations seem to get the short end of the stick. Due to how non-profits work, organizations are already working with limited resources to pay for their office space, equipment, and employees. With the minimum wage increase, many non-profits are expected to shut down because of these strict budgets. Along with this, the US Department of Labor has issued that most employers, including non-profit, will provide overtime compensation to employees earning less than $47,476 annually.

Organizations or those working for one can expect to decrease their employees or restrict their current services. Unfortunately, this proposition is not in favor of businesses with end goals that only benefits others. One possible solution that non-profit owners should consider is to contact the state legislature to receive more funding for their organization.Each individual business is impacted differently by Prop 206, such as tipped employees making $3 an hour less than the average hourly worker. Some owners will also have difficulty in operating their company in multiple states and will have to set up multiple systems to keep track of different wage and leave laws. Keeping up with Arizona business law changes is key to growing a successful company. When it comes to maintaining your system for payroll and paid sick leave, work with someone that you can trust. PayTech works hard to ensure all of your payroll, accounting, and HR are running smoothly so that the time you invest into your business is spent efficiently. Make the most of the new year by rolling with the new transitions as smoothly as possible by contacting a PayTech team member at 602.900.8807.