Whether you have a small business or are bringing your company to a new state, there are certain steps you have to take to know how to start a business in Arizona. The best way to ensure you are following all the right steps is to visit the Arizona Corporation Commission website for instructions. Once you have been approved, you’ll be able to find others to help your business grow.

If you are starting a brand new business and have no clue where to begin, these are the proper steps to becoming registered in the state of Arizona:

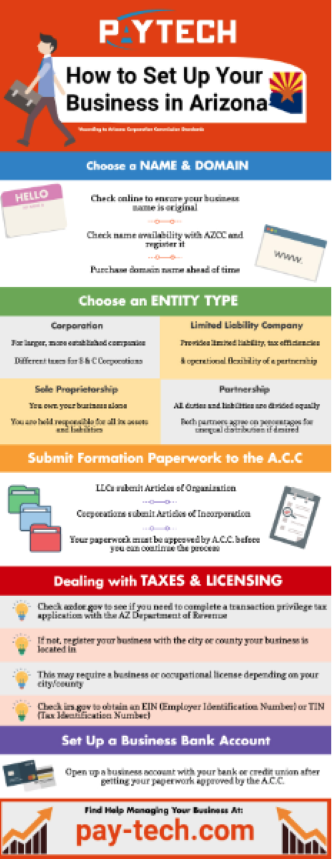

If you want to know how to start a business in Arizona, the first step you must take is to choose a new and original name. One of the easiest ways to accomplish this is to Google your possible name ideas or check name availability with the ACC and register it if it’s not taken. Once you’ve chosen your name, you should purchase your domain name so that you don’t have to worry about it being taken once you get your business running.

There are four types of entity types you can choose from when you set up your business: Corporation, Partnership, Sole Proprietorship, and Limited Liability Company (LLC). Corporations suit bigger, more established companies, Partnerships are good for splitting liabilities. Sole Proprietorship is excellent if you want complete ownership and liability, and LLC is the most flexible entity in regards to limited liability, tax efficiencies, and partnership possibilities.

If your entity is an LLC, you’ll need to turn in Articles of Organization. If your business is a Corporation, you must submit Articles of Incorporation. This paperwork must be approved by the ACC before you can move ahead in the process. If your paperwork is rejected you’ll be given further instructions to correct and resubmit it.

Once approved, you will need to check with the Arizona Department of Revenue website to see if you need to complete a transaction privilege tax application. Otherwise, you can move on with registering your business with the city or county it’s located in, which may require certain business licenses. You can then go to the IRS website to obtain an EIN (Employer Identification Number) or TIN (Tax Identification Number).

The last step is to open up an account with a local bank or credit union. It’s crucial to have an account that is separate from your personal one to deal with all business matters.

Starting up a new business can be a long and difficult journey if you don’t have the right help along the way. Companies like PayTech work hard to assist you in business management services like accounting and payroll so that you can focus on other important aspects of your work. Creating a successful business starts with building your foundation of resources, customers, and employees.