With every paycheck comes two different types of payroll deductions, along with other deductions that vary for each individual. The two consistent types of payroll deduction include federal withholding and state/local withholding. These deductions are taxed at different rates based on your employer, state, or taxable income. For instance, seven states have a flat tax rate on incomes like Colorado, Illinois, Indiana, Massachusetts, Michigan, Pennsylvania and Utah. There are also seven states that don’t enforce an income tax at all, such as Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. Knowing what rates affect your payroll may affect where you decide to work or do business in the future. Here is how your payroll deductions are split up.

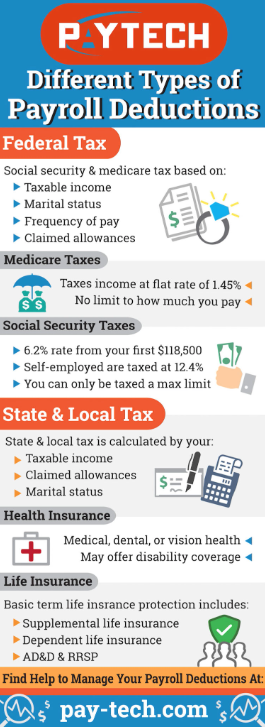

These different types of payroll deductions are withheld and built up over the year, eventually to be applied to the amount of your taxes due at the end of the year. If you end up withholding too much, you get a tax refund. Federal tax withholding includes Social Security and Medicare taxes and is determined by your taxable income, marital status, frequency of pay, and number of claimed allowances.

For 2017, Social Security tax will be withheld from the first $118,500 of an employee’s taxable wages at a flat rate of 6.2 percent. This applies to both employees and employers alike. Self-employed taxes pay the combined rate of 12.4 percent of their net earnings. Fortunately, this means that no matter how much money you make that year, your social security taxes will max out and you’ll no longer have to pay that deduction. However, Medicare is taxed at a flat percentage rate of 1.45, and has no limit on how much you’ll pay yearlong. Both of these payroll deductions will show up on your FICA, and can be determined by the IRS Withholding Calculator.

Like federal tax income, state and local taxes are calculated upon your taxable income, claimed allowances, and marital status. Each state maintains its own updated tax changes, and a few states require unemployment tax as well as disability insurance withholding. Your local taxation may also include city or county taxes individually.

Health insurance:

Life insurance:

At the end of each year, your payroll deductions add up and the IRS allows you to claim a deduction on your federal tax return. A deduction for your state income tax is obtainable only if you are eligible to itemize deductions on your federal return. This requires you to have documentation of your total annual deductible expenses that exceed the standard deduction amount for your filing status. As an individual or a business owner, this can be a crucial part of covering past expenses or charges. Having a dedicated payroll company like PayTech at your side can help make managing deductions a simple task. Avoid losing cash this year and make your job easier by getting in contact with PayTech’s business payroll services at 602.788.1317.