It’s hard to overestimate the importance of proper payroll processing. While your employees may believe in your business, they likely wouldn’t come to work without a paycheck. Making sure that your paychecks arrive on time is just one aspect of having a working payroll system, though. Making sure that system is secure is an important undertaking, one that can impact the future of your business. Taking a moment to look at the basics when it comes to payroll security issues is one of the best ways to ensure that you won’t be caught unaware by them if they occur.

When you’re looking at an issue as important as securing your payroll, it’s important to go back to the basics. There are certainly some incredibly sophisticated tools you can use to keep your payroll secure, but they won’t do you any good if you don’t understand why and how they should be used. That’s why anyone interested in this type of security should start by looking at why payroll processing needs to be secured – and what they can do to ensure that they make use of the best security measures available.

It’s never a bad idea to question why you need certain systems in place. After all, you should never go with something just because it’s the industry standard – you need to understand exactly why you’re undertaking an action before you spend the money on implementation. Fortunately, payroll security is fairly simple to understand. Because your company’s payroll deals with money, some forms of security are automatically understood. Digging deeper, though, will give you a clearer look at why this type of security is so important.

At a basic level, payroll systems need security because they deal with something that’s near and dear to your employees’ hearts.

Payroll that runs efficiently and on time is not just a perk – it’s something that every employee expects from his or her employer. Failures on the payroll front are sure to drag down employee morale and give some of your best employees a good incentive to start looking for work elsewhere. If you’re not closely guarding your payroll, you’re sending a message to your employees that you do not care about their livelihoods.

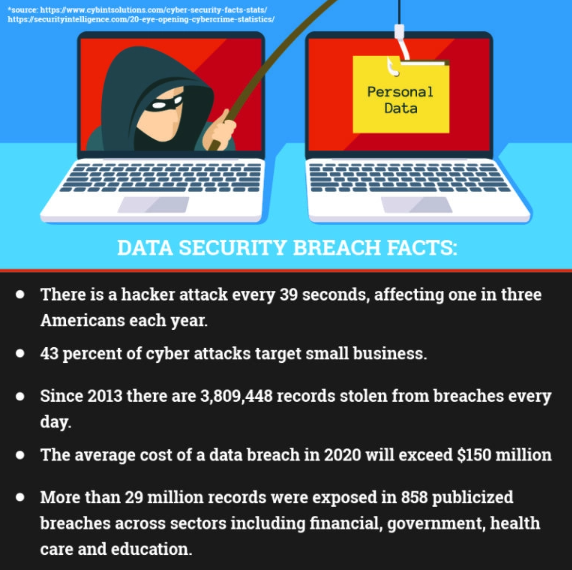

Beyond securing the money that needs to go out to your employees, payroll security is also information security. Your payroll records contain data that can be very dangerous in the wrong hands. Social security numbers, addresses, and other forms of personal data are all stored because they are necessary for properly processing payroll and the related taxes. If someone was to get into your payroll system, you’d be giving them much more than a single payday – you’d be giving those people access to information that could very well ruin the lives of all of your employees.

In fact, the security of your payroll is closely related to the general financial security of your business. If someone is able to penetrate your payroll data, they’ll get access to much more than your employees’ data. They’ll also get access to vital data about your business’ finances and possibly even access to your business’ accounts. If you don’t practice proper payroll safety, you may be setting yourself up for a major financial upset.

This is one of those areas that is, unfortunately, easier for some thieves to penetrate than other aspects of your company’s network, and the damage they can do is fairly significant.

Finally, keeping your payroll secure helps to keep your business’ reputation intact. Failure to have an intact security system can wreak havoc on how you are perceived. Not only will you lose the respect of your employees, but others in your field will begin to wonder how well you are protecting your data in general. This can lose you contracts, vendors, and the relationships that are necessary to keep your business running. If you’re not able to prove that you can keep something as important as payroll secure, you’re signaling that your business isn’t taking information security seriously enough.

It doesn’t matter if you’re doing payroll for two employees or ten thousand – failure to properly account for the security of payroll can destroy your business’ credibility and leave your employees wondering where they’ll find their next paychecks.

Payroll issues vary from company to company. Depending on the size of the business and how it operates, there can be a myriad of issues that impact how well payroll is handled. Fortunately, there are a handful of problems you can watch out for if you’re concerned with the overall security of your payroll system.

One of the biggest security issues is fraud.

This is a problem that’s entirely human in nature, and it generally goes hand in hand with smaller businesses. In the early days of a business, it’s common to have a single person work on payroll. This is a great cost-saving measure for some, though it definitely makes it easier for fraud to occur. After all, a single payroll employee has ultimate power over what goes on with payroll and it can be tempting to fudge the numbers a bit. Security problems in these cases can range from wage theft to stealing personal information, and each issue can quickly spiral out of control.

In fact, most of the issues surrounding securing payroll are very much based around the human element. A lack of proper education on information safety is another major problem in many businesses. While Hollywood might love to glamorize the idea of data thieves as people who perform wizardry with computers, the truth is that most breaches occur because an employee was too quick to give out confidential information to the wrong person. When employees – and especially payroll employees – don’t know how to keep data safe, there are bound to be major problems.

That is not, however, to say that there aren’t very real issues with payroll processing software and online intrusions.

Failure to update software, keep firewalls enabled, and deal with malware in a timely manner is a fantastic way to fall prey to basic scams.

It doesn’t take a mastermind to infiltrate a system with these tools – this is someone who can send out a clever attachment and is willing to wait for a poorly-secured company to take the bait. If you’re not paying attention to your data security, you’re not preparing your business for potential payroll intrusions.

Outside of online data breaches, there are a surprisingly large number of businesses that practice poor data security in the physical space. Not properly disposing of payroll processing documents, for example, is a good way to let your employees’ banking information get out into the wild. Likewise, printing too much data on a payroll check can be a good way to give strangers access to important information. If your business isn’t keeping its traditional data safe, it is putting your employees and your payroll in just as much danger as a failure to guard digital data.

If there’s one common bond between all of these issues, it’s that companies don’t pay quite enough attention to their payroll data. While problems surrounding getting a single check wrong might be fixed quickly, problems surrounding the whole system are often ignored because they are difficult or expensive to fix. All of the problems listed above can be avoided so long as those in charge of the business can be made to realize the fiscal long-term importance of keeping all of their payroll data safe and guarded against outside intrusions.

The best practices in securing payroll are a combination of data security practices, employee training, and old-fashioned financial security.

Some of these practices are more important than others depending on the size of your business, but they should all be put into place as soon as they are appropriate. It is much easier to do so before a situation occurs than after you have to deal with a breach.

Related: Payroll Security Best Practices for Small to Mid Sized Businesses

First and foremost, make sure that you use up-to-date payroll software on systems that are regularly updated. Most people who would attempt to breach your system are counting on out-of-date software that is vulnerable to known exploits. Fortunately, investing in better technology can help make your entire payroll department more productive, so this is one cost that should be easy to justify. If you can’t afford new systems, make sure that the ones you have available are updated and continually monitored.

Monitoring is, in general, another major watchword when it comes to best practices. If you want to prevent easy internal fraud, make sure that more than one person has access to payroll. You should never put this kind of burden on a single employee, so split the duties and make sure that each employee works as a check against the others. Putting together a system that requires employees to stay honest isn’t necessarily burdensome and actually takes some of the pressure off of individuals. If you can remove the ease of fraud, you can remove much of the threat.

Remember to continually review the paperwork of your payroll department.

This isn’t something that can go out and be forgotten. Make sure to set up specific dates for audits and don’t be afraid to inspect the files on a random basis. This isn’t just something that will protect you from fraud – it will also protect you from issues that might have been missed in the interim. These sort of departmental check-ups should be normal for every other department in your business, so no one should treat them as unusual in payroll.

Practicing reasonable data security with your paychecks is also another good way to avoid major problems. On a basic level, this means avoiding printing unnecessary data like social security numbers or full employee addresses on your checks. At a more stringent level, it means keeping blank check stock secured outside of the payroll area and making sure that you keep careful track of who’s actually able to sign off on the payroll. Keeping track of these mundane physical matters can make it much easier to prevent simple fraud.

Finally, another necessary practice is employee education. Make sure your employees understand the impact of payroll fraud and what they can do to stop it. For the most part, that means educating them on things that can be considered fraud, like signing for ghost employees, manipulating time sheets, or other issues. It also means teaching them the importance of data security and how they can avoid some of the more common phishing scams.

One thing you’ll absolutely want to do is an audit of the security of your payroll. This will allow you to learn exactly where you stand in terms of those security best practices and help you to reveal any glaring problems that might occur. This process isn’t necessarily grueling, but it should be thorough enough that you’ll uncover even those problems that are professionally hidden. Your first audit will be the hardest, but it will absolutely be the audit that helps you to redefine your company’s stance on security when it comes to your payroll.

The best place to start an assessment on payroll is with your payroll staff. Every member of your payroll team should have a chance to describe what they do during the day, whether by responding to a survey or through a direct interview. This will reveal a great deal about the daily security practices – follow up questions will be necessary to clarify some procedures. During this time, it will be important to ask those in payroll about ways security could be improved. While not all of these suggestions will be feasible, they could reveal some important weaknesses in your current system.

Your next step should be to look at the data. This means going through the typical process of a payroll audit to determine if any security breaches have already occurred. Yes, this can be a tremendously time-consuming task, but it’s also a very good way to catch issues. It will be easier to tell if there are systemic problems if you can determine whether or not your payroll is able to be reconciled. Remember, a lack of problems here absolutely does not mean that your security is up to par – it just means that no problems have happened yet.

Now that you’ve talked to employees and looked at the payroll data, you can conclude the assessment phase of your audit by taking a look at your payroll systems. Your job will be to find out if they are up-to-date and whether they are systems that have known flaws. This is very likely a job for your IT staff, and the information they return to you will have a great deal of bearing on what you do next. Your investigation of your security systems will allow you a better chance to understand exactly what might need to be changed next.

Your final step is to gather your data. Through talking to your employees, examining payroll, and looking at your systems, you should now have a fair idea of how your current practices compare to the best practices. You’ll have to prioritize what needs to be fixed based on immediate need and the number of resources that your company can dedicate to the problems. Once you know exactly the issues you face, though, you can make rational decisions that will better allow you to both fix existing payroll concerns and to avoid problems that are likely to occur in the future.

Simply put, the security of your payroll really is the security of your company. If you can’t protect this vital resource, you’ll have a hard time protecting the rest of your company’s assets. If you find yourself wondering where to go next, it’s important to remember that you are not alone. It is possible to get the professional help that will allow you to better understand the weaknesses in the security of your payroll and how you can fix those problems. If you’re ready for help, make sure to contact PayTech to get your free payroll security audit.

As you might imagine, it’s possible to make some significant mistakes when you’re dealing with outsourcing payroll. This is a common problem when you outsource any kind of function, so learning how to avoid these mistakes is a necessity. Your first goal should always be to identify what others have done wrong in the past, and then you should work to make sure you can take a course of action that will allow you to avoid those mistakes in the future. Below are three of the most common mistakes companies make when they choose to outsource payroll services – as well as the simple steps you can take to avoid those same mistakes.

Your relationship with your payroll company is one that’s predicated on a signed contract. Unfortunately, far too many businesses make assumptions about what their payroll company will do for them, leaving them to scramble to figure out what needs to be done when they realize that the task they assumed was being done was actually not included in the paid-for service. This extra work leads to extra costs and, in many cases, a fraught working relationship between the payroll processor and the client company.

Tip: Read your contract and make sure you know what is included in your services. If you are not sure about what your payroll company does, just ask your representative. There are many benefits that come with payroll outsourcing, but you can only make use of them if you actually know what they are.

An important term in computing is “GIGO”, or Garbage In, Garbage Out. In short, this means that any process that starts with bad data is going to produce a bad result. As your payroll processing company can only work on the data that you give them, they can only produce the results that come from that data. Many businesses blame their payroll company for problems when the actual issue is the information that has come from the originator.

Tip: Double-check the information that you give to your payroll company before you send it over. Never assume that your numbers are correct – run them a second time and make sure that there is always a second set of eyes on anything you’re sending out. If you are able to send out reliable data, you’ll end up getting reliable results in return.

One of the cardinal sins of business planning is only concentrating on the cost. While there is certainly something to be said for being thrift, you generally get what you pay for when you’re working with payroll outsourcing companies. Going for the bottom dollar might save you money in the short-term, but it can lead to problems in the future.

Tip: Instead of focusing on getting the absolute lowest price, try to focus on getting the best price for the services you actually need. Doing so will give you a much better chance of actually saving money over the long run and give you a good chance to avoid payroll problems in the future. Try to focus on the value of the service rather than just the price tag.